Operational Excellence in Finance 3444893263

Operational excellence in finance is a crucial aspect for institutions seeking efficiency and adaptability. It involves strategic approaches like process optimization and continuous improvement. Financial organizations can benefit from the integration of technology and data analytics to enhance decision-making. However, the challenge lies in fostering a culture that encourages innovation among employees. Understanding how these elements interconnect can reveal significant insights into driving value for stakeholders and achieving long-term sustainability. What are the key strategies that can be employed?

Understanding Operational Excellence in Finance

Although the concept of operational excellence is often associated with manufacturing and service industries, its principles are equally critical in the finance sector.

Financial agility hinges on the ability to adapt swiftly to market changes, while process optimization enhances efficiency and accuracy in financial operations.

Key Strategies for Streamlining Financial Processes

To effectively streamline financial processes, organizations must first identify and implement strategic methodologies that enhance operational efficiency.

Key strategies include cost reduction through the elimination of redundancies and the adoption of process automation to minimize manual intervention.

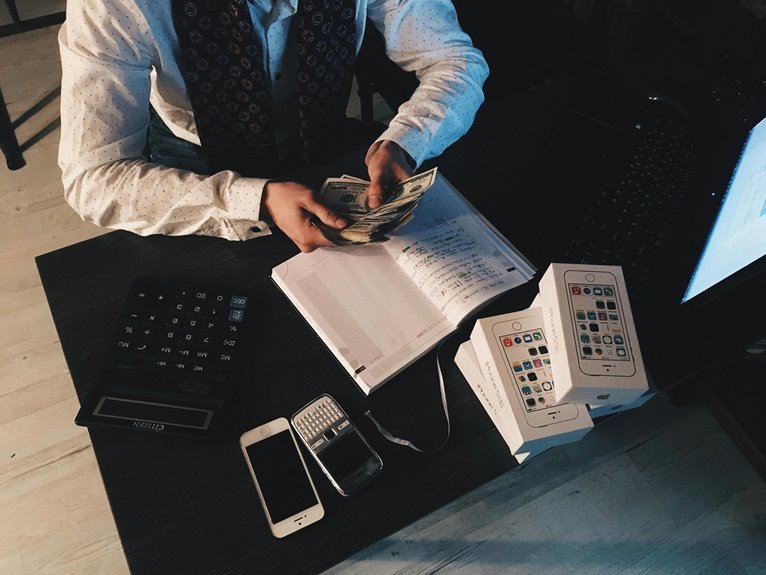

Leveraging Technology and Data Analytics

Harnessing technology and data analytics enables organizations to transform their financial operations into a more efficient and insightful process.

By implementing data visualization tools, companies can present complex financial data clearly, facilitating informed decision-making.

Additionally, financial forecasting analytics empowers organizations to anticipate economic trends, enhancing strategic planning.

This integration of technology fosters a proactive approach, ultimately driving operational excellence and enabling greater organizational freedom.

Cultivating a Culture of Continuous Improvement

Continuous improvement stands as a fundamental principle in achieving operational excellence within finance.

By fostering employee engagement, organizations empower teams to actively participate in process innovation. This culture promotes a proactive mindset, encouraging employees to identify inefficiencies and propose enhancements.

Consequently, financial institutions can adapt swiftly to changing environments, ultimately driving sustainable growth and enhancing overall performance in an increasingly competitive landscape.

Measuring Success and Delivering Value to Stakeholders

While financial institutions strive for operational excellence, measuring success and delivering value to stakeholders remain critical components of their strategic framework.

Effective stakeholder engagement is paramount, as it informs the development of robust performance metrics.

These metrics not only gauge financial outcomes but also assess the institution’s impact on stakeholder satisfaction and trust, ultimately guiding strategic decisions toward enhanced value creation and sustainable growth.

Conclusion

In the realm of finance, operational excellence emerges as a beacon guiding institutions through the fog of inefficiency. As technology intertwines with data analytics, organizations become agile ships navigating turbulent waters. A culture of continuous improvement acts as the wind in their sails, driving innovation and responsiveness. Ultimately, by meticulously measuring success, financial entities can transform intricate processes into streamlined pathways, delivering substantial value to stakeholders and crafting a future defined by resilience and growth.